2023 has been a very eventful year for Bitcoin, with its price experiencing significant fluctuations. After a strong rally, Bitcoin’s value reached near $30,000, coming close to a new 52-week high. Both bulls and bears have shared their perspectives on the cryptocurrency’s performance, and several key factors have influenced its trajectory. There have been several unique catalysts behind Bitcoin’s 2023 rally, which lead to interesting predictions for the future.

Bitcoin’s Price History Since Inception

Bitcoin, founded in 2009 by the pseudonymous Satoshi Nakamoto, has come a long way since its inception. The cryptocurrency started trading on online exchanges in 2010 and surpassed the $1 threshold in April 2011. As its popularity grew, so did its price volatility. In 2013, Bitcoin reached $1,000 for the first time, capturing the attention of investors and tech enthusiasts worldwide.

The most prominent event in Bitcoin’s price history occurred in December 2017 when its value skyrocketed to nearly $20,000, fueled in part by the launch of crypto futures contracts by CME Group. However, the subsequent market downturn in 2018 sent Bitcoin plummeting to less than $4,000.

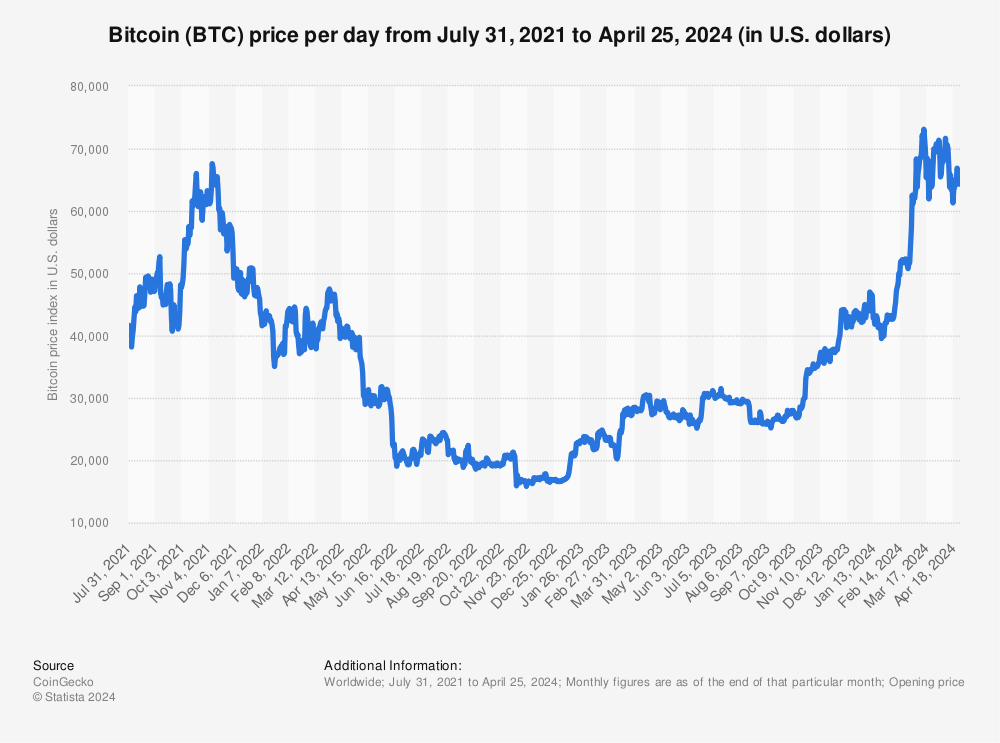

A period of renewed interest in stocks and cryptocurrencies during the COVID-19 pandemic led to another surge in late 2020, propelling Bitcoin to new all-time highs. It reached its peak of $68,990 in November 2021.

Bitcoin (BTC) price per day from Apr 2013 – Aug 01, 2023

Source: Statista

Bitcoin’s Performance since January 2023

The year 2022 was incredibly challenging for Bitcoin, as rising interest rates across the globe triggered a significant sell-off, causing prices to drop by nearly 65%. The collapse of Luna and its associated stablecoin TerraUSD (UST) added to the woes, and major stablecoins temporarily lost their pegs to the U.S. dollar. Consequently, investor sentiment for Bitcoin and other cryptocurrencies reached a cyclical low by the end of 2022, leaving many feeling not optimistic as they entered 2023.

However, 2023 brought a glimmer of hope, as Bitcoin rebounded with a powerful rally, gaining over 75% year-to-date. Factors such as easing inflation data, the pause in Federal Reserve interest rate hikes in June, and the filing of a Bitcoin spot ETF by BlackRock contributed to this aggressive price surge. Additionally, a brief U.S. banking crisis in early 2023 sparked concerns about the traditional banking system’s safety, which further fueled Bitcoin’s rise above $30,000 in April.

Regulatory Landscape and Institutional Interest

Amid the rally, Bitcoin bulls were encouraged by the diminishing fears of contagion among crypto lenders and exchanges that had troubled the market in 2022. BlackRock’s filing for a Bitcoin spot ETF also hinted at renewed institutional interest in cryptocurrencies, raising hopes of a potential influx of institutional investments.

Nonetheless, Bitcoin bears remain cautious, as the path of monetary policy and additional clarity on crypto regulations could significantly impact Bitcoin’s outlook for the remainder of 2023. The U.S. Securities and Exchange Commission’s (SEC) repeated rejections of Bitcoin spot ETF applications based on fears over investor safety further highlight the regulatory challenges faced by the cryptocurrency market.

Bitcoin’s Uncertain Future: Predictions and Possibilities

The year 2023 has shown that predicting Bitcoin’s price movements is a difficult task. While momentum seems bullish so far, uncertainties abound, and various factors will influence Bitcoin’s performance going forward. The potential approval of a Bitcoin spot ETF by the SEC could open the floodgates for institutional investment, potentially sending prices to new all-time highs.

Despite the tremendous fall of Bitcoin in 2022, market experts, such as Ark Invest CEO Cathie Wood, have made ambitious long-term predictions for Bitcoin’s price. Wood has made predictions of Bitcoin hitting $1.5 million by the year 2030.

Looking Upward and Onward

Bitcoin’s performance in 2023 has been marked by significant volatility, with its price surging after an unprecedented fall in 2022. However, forecasting Bitcoin’s future remains difficult due to its inherent unpredictability and the influence of external factors like institutional adoption, global usage, and the evolving regulatory framework. As Bitcoin continues to navigate the uncertain waters of the crypto market, investors and enthusiasts alike will closely monitor its journey, prepared for the twists and turns that lie ahead.