Since bitcoin’s inception in 2009 to the late 2010s, it has shown a lack of correlation to the broader stock markets. Because of this, bitcoin proved to be an asset class for investors that remained largely independent of broader markets.

However, with an increase in awareness from retail and institutional investors, beginning largely in 2017 when BTC pushed through the USD$10,000 threshold, its independence has waned.

Increasing Interest Rates

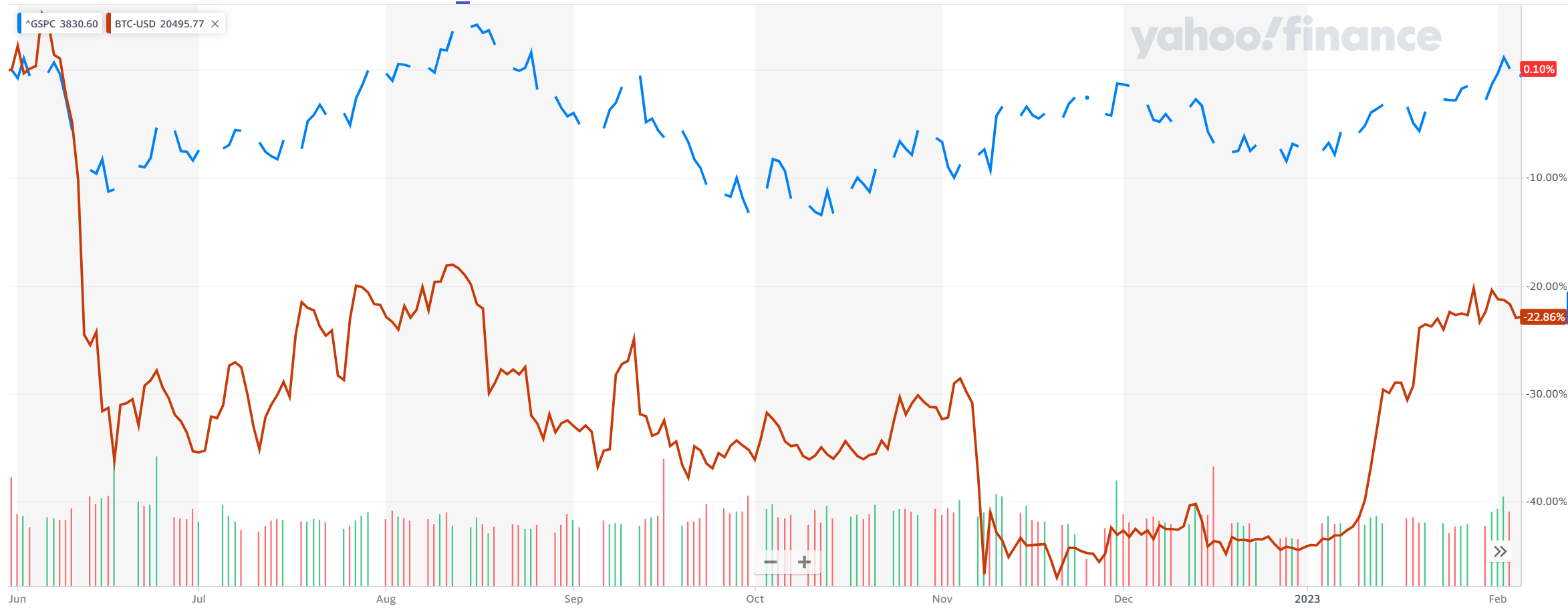

For most of the last twelve months, bitcoin has been fighting the same downward pressure that’s been impacting both the stock and bond markets. Major central banks around the globe have been on a quest to tighten monetary policy in a battle to tame inflation down to a target of two percent.

“The price of bitcoin is maintaining the $19,000 level, but with the FOMC’s minutes and CPI ahead this week, the market will likely refrain from taking risks, which in turn will likely put pressure on bitcoin,” said Yuya Hasegawa, crypto market analyst at Bitban.

Macroeconomics

Macroeconomic factors continued to play an important role in driving the prices of cryptocurrencies, as well as other risk assets. Throughout the third quarter, the correlation of bitcoin with major stock indexes remained high, at over 60%.

For added context, a correlation above 50% is considered moderately strong and above 70% is very strong, while correlations between 30% and -30% are very weak. A value of 100% or 1 means that movements between bitcoin and the broader markets are perfectly synchronized.

With rising interest rates, investors wanting to de-risk their portfolios have weighed on bitcoin’s price as reflected in a rather underwhelming yearly performance of negative 37% as of January 31, 2023.

Some examples provided by Fidelity Investments of bitcoin’s price following macroeconomic announcements in 2022:

- July 27: BTC increased by over 8% following the announcement by the Federal Reserve that it was raising interest rates by 75 basis points.

- August 10: July U.S. CPI inflation came in below expectations at 8.5% (compared with 8.7% expected). BTC climbed 4% in the hours following the release of the CPI before slowing later in the day.

- August 19: BTC plunged nearly 10%, falling in sync with traditional markets amid renewed fears that the Fed and other central banks will have to get more aggressive in fighting inflation. The decline started with unexpectedly high inflation data in Germany.

- August 26: BTC dropped after Fed Chair Jerome Powell doubled down on restrictive monetary policy at the Fed’s Jackson Hole economic symposium.

- September 13: BTC fell on the release of August U.S. CPI data, which showed an unexpectedly high 8.3% increase in prices (compared to 8.1% expected).

With its widespread adoption, it is clear that bitcoin is no longer on the fringe of the financial system. Tensions between Russia and the West over the Ukraine war could continue to roil markets, from energy prices to foreign exchange. Bitcoin’s tighter correlation with broad markets means it will not be immune.

Conotoxia Senior Market Analyst Daniel Kostecki gave his opinion on this correlation to CoinDesk last year.

“It is what is happening in the arena of international relations that seems to be the main driver of the markets for both stocks and cryptocurrencies,” he said.

2023 Bump

Ask yourself, Why should Bitcoin have a 40% pump when nothing special has happened in the stock market?

Moreover, $VIX & $DXY are on technical support and ready to bounce up which will be bearish for risky assets!#Crypto #cryptocurrency #BTC #Bitcoin pic.twitter.com/gmXC4lXFqi

— Dollarcurrency21 (@Dollarcurrency1) January 21, 2023

As of January 31, 2023, the YTD of bitcoin is up approximately 39%, while the S&P 500 and Nasdaq Composite are up 5.9% and up 10.8% respectively.

Analysts say that there is a multitude of factors behind bitcoin’s new rise in 2023, including the probability that interest rates will be lowered in the coming months, easing of short-term inflation, as well as massive purchases by large buyers, otherwise known as “whales.”

The U.S. dollar has also lowered, with the greenback down 8.5% in the last three months in terms of its strength against a basket of other notable currencies, such as the Euro, Pound and Yen.

If this is the case, bitcoin continues to show a coupling with macroeconomic indicators, despite showing less correlation with stock markets.

As bitcoin’s adoption continues to increase along with the development of applications built on top of the blockchain it is likely we would see a decoupling between the cryptocurrency and stock markets in the future.

“We expect them to not be as highly correlated going forward,” Ben McMillan, CIO of IDX Digital Assets said. “But I do think a positive correlation between bitcoin and risk assets, in particular things like technology stocks, is here to stay.”

That said, bitcoin is still a relatively new asset class when compared to its counterparts, like bonds, stocks and gold. Its relationship with them and macroeconomics will be closely watched.