FAQs

HoneyBadger is a leading noncustodial cryptocurrency network company that specializes in providing innovative solutions for the Bitcoin and cryptocurrency market in Canada.

- Buy & Sell at ATMs: HoneyBadger has a network of over 200 Bitcoin ATMs across Canada for simple buying and selling of cryptocurrency with cash.

- Buy & Sell OTC: HoneyBadger’s team of experts facilitates purchase and sale of cryptocurrencies over the phone.

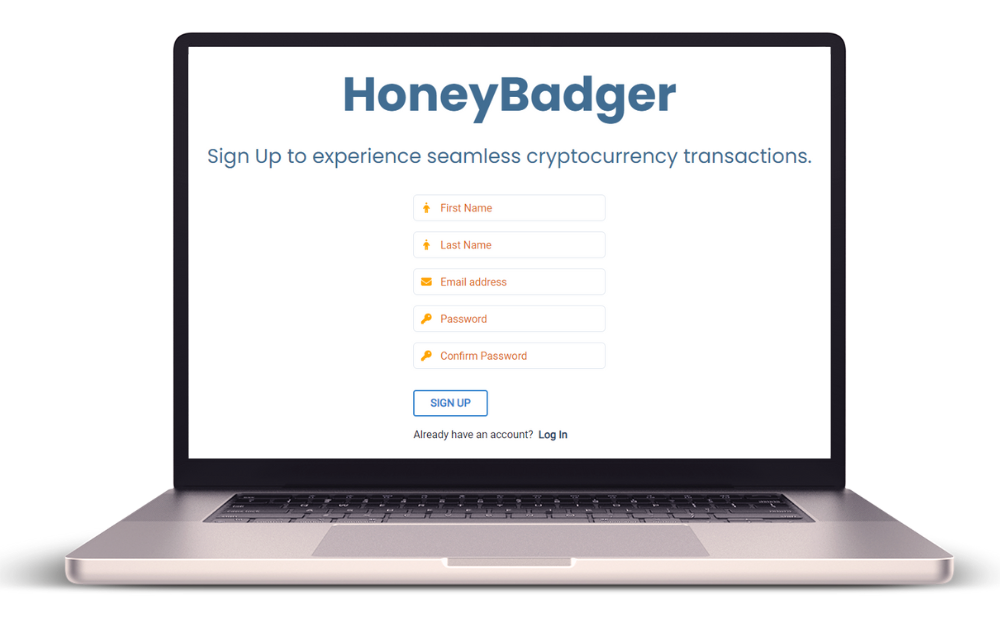

- Buy Online: Honeybadger’s online platform, hosted on etransfer.badgercoin.com, allows you to buy cryptocurrency with various payment methods, including Visa, Mastercard, and Google Pay. Payment via Debit and INTERAC e-Transfer will be available in the near future. The ability to sell via the online platform is also coming soon.

Yes, HoneyBadger is fully regulated and registered with FINTRAC and Revenu Québec, ensuring compliance with all Canadian regulations. See our registration as a Canadian Money Services Business (MSB) here.

HoneyBadger offers a variety of cryptocurrencies for purchase, including Bitcoin, Ethereum, Litecoin, and more.

We accept various payment methods, such as cash, credit, debit, wire transfer, certified cheque, bank draft, and other options. Contact us if you have any questions or need assistance.

Yes, in order to buy cryptocurrencies at our ATMs, online, or through our OTC desk, you must have a cryptocurrency wallet, a digital bank account that allows you to store, send, and receive cryptocurrency securely. Your cryptocurrency wallet will have a wallet address, a 32 to 64-character-long alphanumeric string which is a unique identifier used to receive and send cryptocurrencies.

We recommend using Blockstream Green, an industry leader with top security, but you can also search for other cryptocurrency wallets by searching online or in your app store.

Typically, you will see your purchased cryptocurrency appear in your cryptocurrency wallet within one hour, but this will vary due to blockchain confirmation times. If you do not receive your coins within 24 hours, please contact our support team at support@badgercoin.com or 1-855-499-1149.